In the increasingly digital world of finance, finding the right platform for forex trading Trading Platform CM is more crucial than ever. Forex trading, with its rapid pace and high risk, requires a platform that is both reliable and robust. This article will delve into the essential aspects you should consider when choosing a Forex trading platform, helping you make informed decisions for your trading journey.

Understanding Forex Trading Platforms

A Forex trading platform is a software that allows traders to access the foreign exchange market. These platforms can range from advanced desktop applications to user-friendly mobile apps. The right platform can make a significant difference in your trading experience, as it impacts your ability to analyze market data, execute trades, and manage your portfolio efficiently.

Key Features of Forex Trading Platforms

When evaluating Forex trading platforms, consider the following key features:

- User Interface: A clean, intuitive interface enhances the trading experience, making it easier to navigate and execute trades.

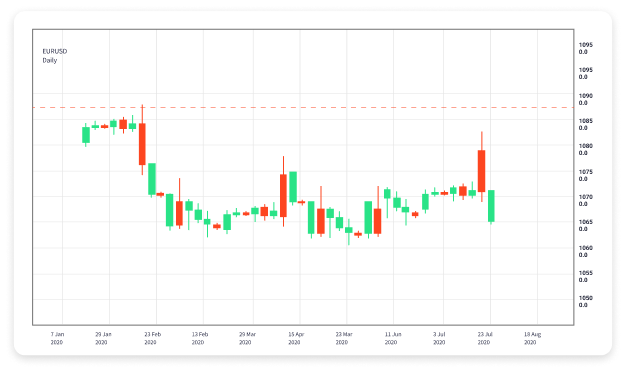

- Charting Tools: Advanced charting tools are essential for analyzing market trends and making informed trading decisions.

- Execution Speed: Fast execution of trades is critical. Delays can lead to losses, especially in volatile market conditions.

- Trading Instruments: Ensure the platform offers a variety of currency pairs and other financial instruments to diversify your portfolio.

- Fees and Commissions: Be aware of any trading fees, spreads, and commissions that may impact your overall profitability.

- Customer Support: Reliable customer service can help resolve issues quickly, which is vital in the fast-paced world of Forex trading.

Types of Forex Trading Platforms

There are primarily three types of Forex trading platforms:

1. Desktop Platforms

Desktop platforms are robust, feature-rich applications that provide extensive tools and functionalities for serious traders. They typically require installation on a computer and offer advanced charting options and real-time data.

2. Web-Based Platforms

Web-based platforms enable traders to access their accounts through a web browser. They are particularly convenient for those who prefer not to download software and want to trade from any device with internet access.

3. Mobile Trading Apps

Mobile trading apps offer flexibility for traders on the go. While they may not provide as many features as desktop platforms, they often include essential tools for executing trades and monitoring markets.

Choosing the Right Forex Trading Platform

Here are some steps to help you choose the right Forex trading platform for your needs:

- Define Your Trading Needs: Assess your trading style—whether you are a day trader, swing trader, or long-term investor—and choose a platform that aligns with your strategy.

- Compare Platforms: Research different platforms, read reviews, and perhaps even test demo accounts to get a feel for their features and user experience.

- Check Regulation: Ensure that the platform is regulated by reputable authorities to increase your security and trust in the system.

- Look for Educational Resources: A platform that offers educational materials, webinars, and tutorials can significantly enhance your trading skills, especially if you are a beginner.

Popular Forex Trading Platforms

Several popular Forex trading platforms are widely used among traders. Here are a few notable options:

1. MetaTrader 4 (MT4)

MetaTrader 4 is one of the most popular Forex trading platforms globally due to its user-friendly interface and advanced charting capabilities. It allows for algorithmic trading via Expert Advisors, making it suitable for both beginners and seasoned traders.

2. MetaTrader 5 (MT5)

The successor to MT4, MetaTrader 5 offers additional features, including more technical indicators, timeframes, and support for stocks and futures trading, making it a versatile choice for many traders.

3. cTrader

cTrader is another advanced platform that offers a vibrant trading ecosystem with its rich set of features, customizable interface, and focus on ECN trading, appealing to professional and institutional traders.

Conclusion

In conclusion, the right Forex trading platform can greatly enhance your trading experience, providing you with the necessary tools and features to trade effectively. Whether you are a novice or an experienced trader, investing time in selecting the right platform will pay dividends in the long run. Keep in mind the factors discussed in this article, and don’t hesitate to explore various options to find a platform that suits your trading style and goals. Happy trading!