Pocket Option Strategy for Beginners

In the world of online trading, finding the right strategy can be a game-changer for beginners. The pocket option strategy for beginners pocket option strategy for beginners will equip you with the fundamental tools needed to enter the market confidently. This article delves into several key components that can help novices navigate the often complex world of option trading and yield successful trading experiences.

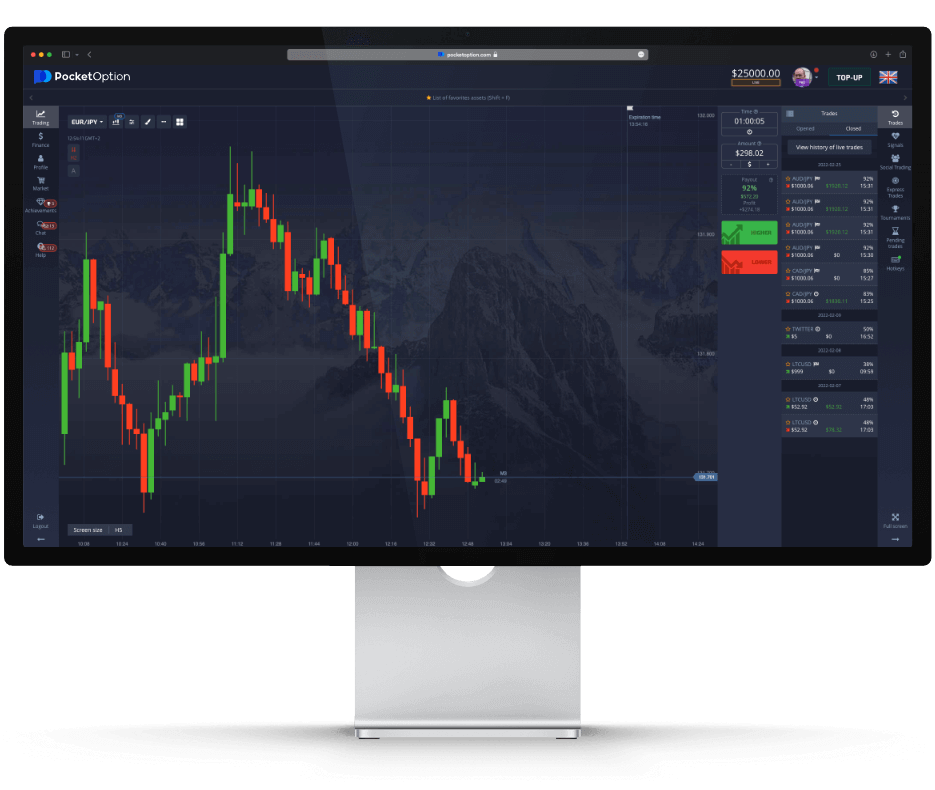

Understanding Pocket Option

Pocket Option is an easy-to-use trading platform that caters to both novice and experienced traders. It offers a range of financial instruments, including forex, commodities, and cryptocurrencies, making it accessible for diverse trading interests. One of the standout features of Pocket Option is its user-friendly interface, which simplifies the trading process and allows beginners to focus on strategy rather than getting bogged down by technicalities.

Setting Up Your Account

The first step for any new trader is to set up an account. Pocket Option provides a straightforward registration process. Once you’ve created an account, take advantage of the demo account option which allows you to practice trading with virtual funds. This is a critical step for beginners as it helps build confidence and familiarity with the trading environment without the risk of losing real money.

Choosing the Right Assets

As a beginner, it’s essential to start with assets you understand. Focus on a few that you believe will yield favorable returns. Pocket Option offers various options, including currency pairs, commodities, and digital currencies. Conducting market research and technical analyses will enable you to make informed decisions regarding asset selection.

Technical Analysis Basics

Technical analysis entails examining historical price movements to predict future price behavior. For beginners, it’s vital to grasp the basics of reading charts and identifying trends. Familiarize yourself with essential technical indicators such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands. Each indicator can offer insights into potential entry and exit points, making them invaluable tools for devising a successful trading strategy.

The Power of Candlestick Patterns

Candlestick patterns are also crucial for understanding market sentiment and potential reversals. Learning to recognize patterns such as Doji, Hammer, and Engulfing can significantly aid your trading decisions. These patterns reflect market psychology and can provide early signals about potential price movements.

Developing a Trading Strategy

Once you have a grasp of the basics, it’s time to develop a trading strategy. Here are a few strategies tailored for beginners:

- Trend Following: This strategy involves identifying and following market trends. If a particular asset is trending upwards, you would buy (call option), and if it’s trending downwards, you would sell (put option).

- Range Trading: Range trading focuses on identifying price ranges and trading between support and resistance levels. Buy at the support level and sell at the resistance level.

- News-Based Trading: Trading decisions based on market news can be effective. Be sure to keep updated on relevant market news that may affect asset prices.

Risk Management Strategies

No trading strategy is complete without robust risk management. Beginners should aim to protect their capital through disciplined trading practices. Here are some fundamental risk management strategies:

- Set Stop-Loss Orders: A stop-loss order automatically closes your position if the price reaches a certain level, limiting potential losses.

- Only Invest What You Can Afford to Lose: Risk only a small percentage of your total capital on a single trade to ensure that one bad trade doesn’t significantly impact your trading account.

- Diversification: Spread your investments across different assets to minimize risk. This way, the poor performance of one asset can be offset by the better performance of others.

Emotional Discipline in Trading

Emotional discipline is crucial in trading, especially for beginners. It’s easy to make impulsive decisions driven by fear or greed. Develop a trading plan, and stick to it — avoid making trades based solely on emotions. Consider keeping a trading journal to track your trades, emotions, and strategies, which can help you refine your approach over time.

Continuous Learning and Adaptation

The financial markets are constantly evolving, and successful traders must adapt to these changes. Commit to continuous learning by reading books, taking online courses, and following successful traders. Engaging with trading communities can also provide support and insights that can help enhance your strategies.

Conclusion

Starting your trading journey on Pocket Option can be both exciting and daunting. By understanding the platform, employing effective strategies, practicing risk management, and maintaining emotional discipline, beginners can set themselves up for success. Remember, trading does not guarantee profits — it requires dedication, learning, and a willingness to adapt. As you venture into the world of trading, remain patient and persistent, and you may find it to be a rewarding experience.